Brief history

On Nov 22, 2019 1,000,000,000,000 XTN were issued by this transaction. The XTN token was issued as not reissuable, that is, it cannot be reissued, the number of existing tokens is finite and limited. The issued tokens have been locked on the contract to exclude them from circulating supply.

There are two ways to get XTN into circulation:

- invoke the Buy XTN transaction (aka issue XTN) on the smart contract. (!) This operation is currently suspended.

- exchange SURF to XTN when XTN price > $1.15 (see more details in SURF documentation)

To take XTN out of circulation, the opposite Sell XTN (Burn) operation is called on the smart contract. It returns tokens back into the “locked” storage. At the same time, they are not technically burned (you can see all locked tokens at the main Neutrino contract balance).

Why was such a technical solution chosen?

Neutrino protocol was a pioneer dApp in the Waves ecosystem. It was developed using the earliest Ride smart contract language. The newborn language had many limitations and didn’t include such convenient and flexible actions like Issue and Burn.

This rather limited environment “forced” the team to invent a solution to issue a big batch of tokens with their subsequent lock.

Disabling Buy/Issue XTN operation

After transforming XTN into index and depositing WX and VIRES to the reserves, the Buy/Issue XTN operation was disabled to prevent huge arbitrage between contract and market price. In a while Waves miners also agreed to share their ⅓ part of block reward (2 WAVES) to organize XTN buy back process that is still going on and can be checked at buyback contract. Miners buyback process still affects the market price which is kept higher than contract price and as a result Buy/Issue operation is suspended.

Idea

Please consider in this proposal to

- burn all preissued XTN on the main Neutrino contract

- remove Buy/Issue XTN operation and keep Sell/Burn XTN only

- do not burn XTN received from the miners’ buyback process to allow convert SURF into XTN in the future

Profits

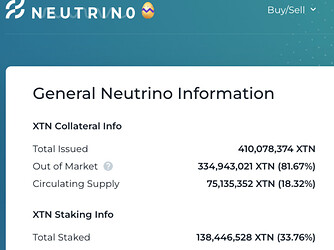

The proposed changes will essentially reduce max XTN supply and turn XTN into a non-issuable index. Only circulating and out of market supplies of XTN will exist, as for now it is around ~410mln XTN:

Regular miners’ buyback will increase XTN market value in the long term perspective and fear of extra emission will disappear because physically it will not be possible to issue new XTN. The price of XTN should go up. SURF will become one and only way to bring XTN into circulating supply again in the future.

To proof that miners’ buyback works you can check the current results at the chart below:

Almost 186mln XTN have already been burnt in less than a year. Let’s imagine, for example, that the WAVES prices reaches $10, then 1440(blocks a day)*2(WAVES)*365(days a year)*$10(WAVES price)/$0.05(current XTN market price) = ~200mln XTN can be burnt in a year. Such buyback will create an essential market pressure and XTN can show a good performance.

In addition to all of this, do not forget about the XTN and WIND collaboration that will bring an extra income into Neutrino DAO.