EAST.Finance Seed Funding: 7.5% of Total ORIENT Emission in Exchange of $50k of PowerDAO XTN Funds

What is EAST.Finance?

EAST.Finance is an overcollateralized DeFi protocol built on SafeFi principles. SafeFi concept is the next move of traditional DeFi evolution, solving all of its traditional problems: opaque, shady profit models; insecurity; inaccessibility of collaterals.

EAST is planned to become a global stablecoin for Waves and Waves Enterprise ecosystems. Such a position causes its huge potential. In general, EAST.Finance economic model is rather simple and similar to another reliable stablecoin, DAI. We’re using the best market practices, proven even in bad market times like now. So we have a strong belief in EAST success.

EAST.Finance in detail

EAST.Finance stablecoin, EAST, is collateralized according to the collateral debt model, with liquid crypto assets — WAVES, WEST, BTC or ETH — at 150% or bigger backing ratio. This is a rule of thumb. The EAST with insufficient backing ratio gets liquidated by the community or the team. Users can liquidate up to 50% of any EAST vault with an insufficient backing ratio. As a result, the protocol liquidity won’t become stuck in “whale” positions; at the same time, vault owners can’t lose all their collateral in a momentary recession.

EAST peg is ensured by a number of mechanics:

- Changing EAST stability fee helps to balance users between issuing EAST and buying it from the market.

- Stability fee is used to grow a safety cushion for the protocol.

- EAST redeeming within the protocol will help to increase its price and restore the peg.

- “USDT as a collateral” option will also be available when necessary for the protocol’s health.

EAST offers various investment opportunities. You can trade with leverage. You can short EAST collateral. You can invest in EAST pools at WX Network. You can redeem EAST, using the protocol crypto collateral. Or you can choose the safest paths — native PoS staking.

And this is where we’re coming to ORIENT, because you’ll be able to stake both EAST and ORIENT the same way!

What is ORIENT?

We want to support our investors as much as we can, so we’re launching ORIENT – an incentive token for all EAST users. ORIENT distribution is as simple as that: all EAST owners get ORIENT just for keeping their EAST positions active, in accordance with their share of total EAST emission.

| Purpose | Share | Sum and period |

|---|---|---|

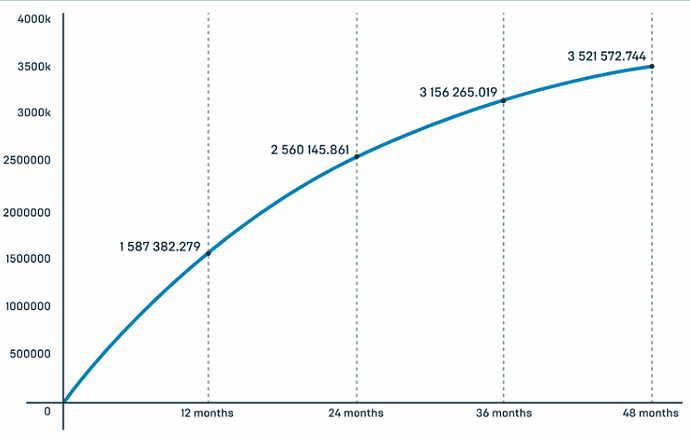

| Mining program | 65% | 3,521,572 ORIENT during 4 years |

| Team support | 10% | 538,461 ORIENT during 2-year linear vesting |

| DEX initial liquidity | 10% | 538,461 ORIENT |

| PowerDAO proposal | 7.5% | 403,859 ORIENT during 1 year |

| Marketing, community, other activities and collabs | 7.5% | 403,859 ORIENT |

ORIENT tokenomics

ORIENT mining program

EAST users need to support their EAST positions to get ORIENT, but PowerDAO needs only a one-time payment. As ORIENT emission is limited, it becomes a deflationary token with a growing income from EAST.Finance protocol. That means the ORIENT price will also grow over time.

By default, ORIENT stakers will get 30% of the total protocol revenue, paid in EAST. The other 70% goes to EAST stakers. Such flexibility enables advanced yield farming strategies.

EAST DAO

This year, we are going to move EAST governance to a DAO model. This will secure further development of EAST and investors’ interest. The DAO members will determine:

- what part of protocol’s income goes to EAST or ORIENT stakers,

- what kinds of collateral can be used to issue EAST,

- what stablecoin is used to prevent the depeg to a higher price,

- where EAST stability fee goes — WEST buyout, EAST issuance or something else

Current traction

Today, EAST is deeply integrated into the Waves ecosystem. The stablecoin has various liquidity pools in WXNetwork — with WAVES, XTN and WEST. All the pools participate in extra WX distribution. Also, EAST is listed at Swop.Fi and Puzzle Swap.

We also launched migration for EAST-OLD owners. We deeply appreciate the loyalty of those who joined us when we first introduced EAST a long time ago, so they can exchange their old EAST for the shiny new one at a 1:1 ratio in just a couple of clicks.

Roadmap

We have plenty of plans for the next months in order to make EAST even more attractive for investors.

| What | Why | When |

|---|---|---|

| EAST and ORIENT staking | To provide more opportunities for extra income | Q2 2023 |

| WX/EAST and ORIENT/EAST pairs | To increase circulation and strengthen the tokens | |

| EAST redeeming | To protect EAST from depeg to a lower price | H2 2023 |

| USDT as a collateral | To protect EAST from depeg to a higher price | |

| USDT/EAST pair | To increase circulation and strengthen the token | |

| Flash loans | To increase circulation and the protocol’s income | |

| EAST DAO | To secure the protocol development |

What do we offer?

To be brief, we, EAST.Finance team, offer 7.5% (nearly 403,859) of the total ORIENT token emission in exchange of $50k in XTN. The sum of ORIENT, an EAST.Finance incentive token, will be transferred evenly during 12 months since the emission starts. The XTN in return is expected to be a one-time payment.

Despite having very close relations with Waves Enterprise, EAST.Finance team remains independent. We’re counting on your support in this proposal. PowerDAO XTN supply will strengthen EAST.Finance even further. We plan to use it:

- to diverse collaterals,

- to strengthen token peg,

- to replenish the treasury,

- to issue more EAST for new trading pairs.

- to support the team

We consider our offer to be mutually beneficial for both PowerDAO and EAST.Finance. 403,859 ORIENT for $50 000 means the ORIENT price for PowerDAO is nearly $0.18. This is 20–50% less than planned for free circulation.

If you want to dig deeper into our protocol, please visit east.finance. Soon we will announce our plans for 2024. Feel free to ask any questions!