Hey guys,

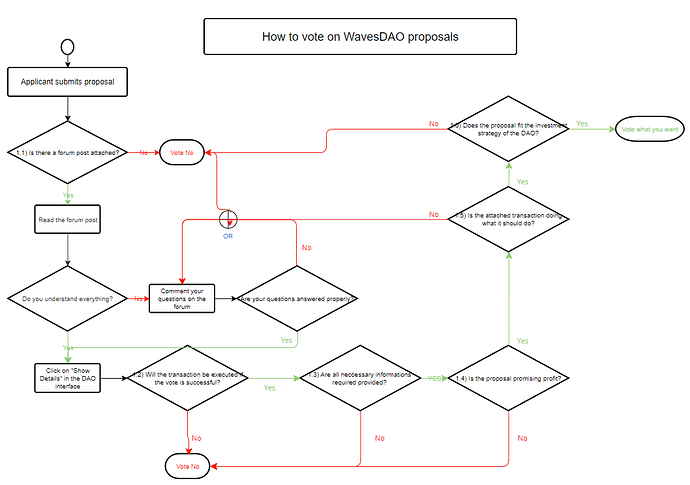

i think it is time that we put together some code of conduct. Basically some basic procedere which should be executed by every PWR comittee before every vote. I created a Flow-Chart to visualize the process. I tried to make the process as objective as possible. You just start at the top left corner and proceed to answer the yes/no questions. What do you think? What should be added/removed? Below you will find a bit more detailed description of the questions.

1.1) Is there a forum post attached? - Why is the forum post important?

It is important to have a forum post because there is no other way to make comments to the proposal. If there is no forum post attached the discussion can only happen in telegram chats. This is problematic because they are not neccesarily known to the PWR comittees. A missing forum post should almost always lead to an instant rejection, except for minor proposals (e.g. staking Waves).

1.2) Will the transaction be executed if the vote is successful? - Why is this important?

For the second part in the formal check the proposed transaction itself should be examined. If the vote is successfull, will the transaction be executed? Is the timestamp set properly? Will there be enough funds to execute the requested transaction? Does the address fit the purpose of the proposal (look for “forgotten” dapp scripts or unwanted bot activity on the address)? If possible the transaction should always be a direct interaction with a dapp (e.g. reject a proposal where the applicant ask to put liquidity into a liquidity pool if the proposed transaction is a transfer transaction to the address of the applicant instead of directly calling the dapp from the DAO address. This gives the DAO the possibility to withdraw liquidity via vote instead of relying on the goodwill from the reciever of the funds. If the transaction is doomed to fail in case of successfull vote or makes the DAO unnecessarily loose control of the sent funds it should lead to an instant no-vote without a further check-up of the proposal.

1.3) Is all neccessary information provided? - Why information matters

The proposal or the attached forum post should contain some basic informations. Who submitted the proposal? Does the proposal provide information about the team behind the proposal? What is the track record of the team? Does the proposal name concrete and measurable targets? It is important to measure the success of each proposal (e.g. applicant offers tokens in exchange for DAO funds the value of the recieved tokens would be a measureable metric of the success of the proposal). If basic information is missing the proposal should be rejected.

1.4) Is the proposal profitable? - Why profit matters

It may sound simple, but it is very important that the proposal is profit oriented. The WavesDAO is designed as for-profit DAO, so the proposal should promise profit. The requested amount of funds shouuld stand in relation to the expected profit. Only benefitial proposals for the WavesDAO should be further examined. This could be a promising opportunity to farm APY, promising tokens at a discount or similar. If the proposal is unlikely to bring the WavesDAO profit it should be rejected.

1.5) Is the attached transaction doing what it should do? - Why the JSON matters

Obviously it is important that the attached transaction is doing what is described in the proposal. Does the attached JSON perform the result which is described in the proposal? All amounts correct? Double check with 1.2) here. If you are not this much of a technical person you can ask in the various communities like the forum or telegram groups other people about their opinion. If there is a mistake in the transaction or the transaction is designed to call a malicious dapp or just do something completely different then the proposal describes it should be rejected.

1.6) Does the proposal fit the investment strategy of the DAO? - Why the strategy of the DAO matters

This point is a bit sketchy because it is very subjective. In general you should always consider the current sentiment. Is the DAO in shape for a funding request this size? Is the timeframe reasonable? Always keep in mind the 3 month cycles. Of course the investment strategy is dynamic and if you are unsure if the proposal fits the current strategy of the DAO just get in touch with the community and hear others opinions. If you come to the decision that the proposal doesnt fit the investment strategy because it has a too long timeframe or is to risky or to unrewarding the proposal should be rejected.

Let me know what you think!

Cheers

Lennart